The gig economy has provided Australians with flexible ways to earn supplementary income, and delivering for Uber Eats in Australia is one of the most popular options. Whether you are a student, a stay-at-home parent, or simply looking to top up your primary income, this comprehensive, step-by-step guide is focused specifically on the Australian market to help you get started and maximize your earnings.

Why Choose Uber Eats in Australia?

The primary appeal of becoming an Uber Eats delivery partner is the unmatched flexibility 12. As an independent contractor, you are your own boss, with the freedom to:

•Work on your own schedule: Log in and out of the app whenever you choose, with no minimum hours required.

•Choose your vehicle: Deliver by car, scooter, motorbike, or even bicycle, depending on your city and preference.

•Earn extra cash: It is an excellent way to monetize your downtime, such as during evenings or weekends.

Step 1: Meet the Essential Australian Requirements

Before you begin the application process, you must ensure you meet the basic eligibility criteria set by Uber Eats for the Australian market

| Requirement Category | Specific Requirement for Australia |

| Age | Must be 18 years of age or older. |

| Identification | Valid Australian Driver’s Licence (for car/scooter/motorbike) or other valid ID. |

| Vehicle | A registered vehicle (car, scooter, or motorbike) with valid registration and insurance, or a bicycle. |

| Smartphone | A modern smartphone (iOS or Android) capable of running the Uber Driver app. |

| Background Check | Must pass a criminal background check and, in some states, a driving history check. |

Step 2: The Crucial Legal Setup (ABN & GST)

As an independent contractor in Australia, you are running your own business, which requires two key legal steps.

2.1 Get an Australian Business Number (ABN)

This is mandatory for all Uber Eats delivery partners in Australia. An ABN is a unique 11-digit number that identifies your business to the government and the community.

How to get your ABN:

- Visit the Australian Business Register (ABR) website.

- Apply for a free ABN as a “Sole Trader.”

- The process is straightforward and can often be completed in a single session.

2.2 Understand Goods and Services Tax (GST)

You are generally not required to register for GST unless your annual gross income from all business activities (including Uber Eats) exceeds the GST threshold of $75,000.

- Below $75,000: You do not need to register for GST.

- Above $75,000: You must register for GST and charge GST on your services.

Tip: Keep detailed records of all income and expenses (fuel, maintenance, phone plan, etc.) as you will need them for your annual tax return.

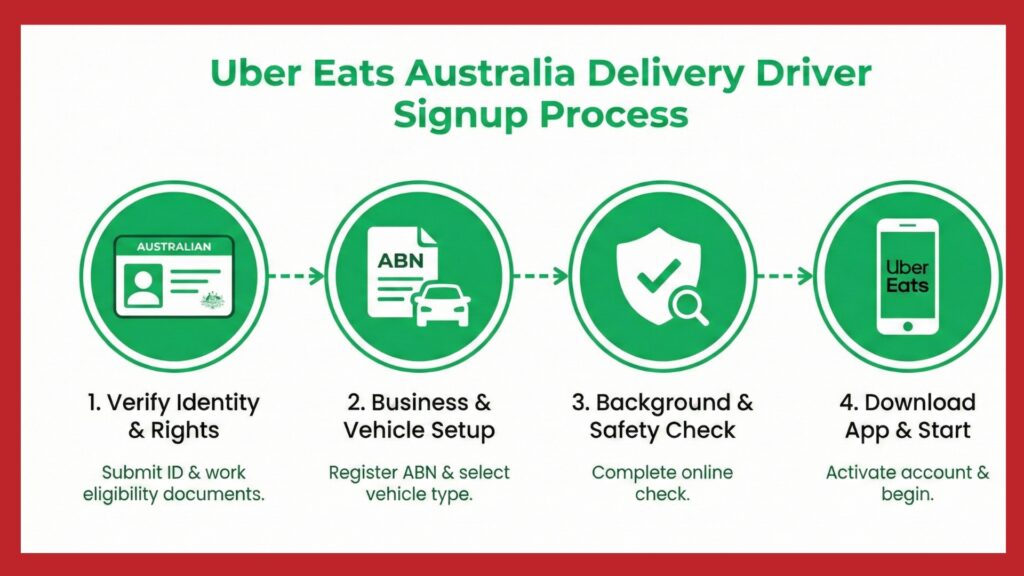

Step 3: The Uber Eats Sign-Up Process

The application is done entirely online through the Uber Eats website or the Uber Driver app

- Start the Application: Go to the Uber Eats sign-up page for Australia and select “Deliver with Uber Eats.”

- Select Your Vehicle: Choose your preferred method of transport (Car, Scooter, Motorbike, or Bicycle).

- Upload Documents: Upload clear photos of your required documents, including your Driver’s Licence, vehicle registration, and proof of insurance.

- Background Check: Consent to the background check. This process is handled by a third-party provider and can take several days to a few weeks.

- Finalize Account: Once your background check is cleared and documents are verified, your account will be activated.

Step 4: Essential Equipment and App Navigation

Before you hit the road, a few pieces of equipment are essential for a professional and efficient service.

| Item | Purpose |

| Thermal Delivery Bag | Mandatory for keeping food hot or cold. Uber often provides a starter bag, but a high-quality, large bag is recommended. |

| Phone Mount | Crucial for safe navigation and accepting orders while driving/riding. |

| Power Bank | The Uber Driver app and GPS are battery-intensive. A reliable power bank is non-negotiable. |

| Safety Gear | High-visibility vest (especially for cyclists/scooters) and appropriate helmet. |

Using the Uber Driver App

The app is your central hub for earning. You simply tap “Go” to start receiving delivery requests. The app will provide:

•Pickup Location: The restaurant’s address.

•Drop-off Location: The customer’s address.

•Estimated Earnings: The amount you will earn for the trip, allowing you to decide whether to accept or decline the request.

Step 5: Maximizing Your Earnings (Tips from Australian Drivers)

To move beyond minimum earnings and make the most of your time, adopt these strategies used by experienced Australian delivery partners.

1. Target Peak Hours and Locations

Earnings are highest during periods of high demand, which typically correspond to meal times.

| Peak Time | Focus |

| Lunch | 11:30 AM – 1:30 PM (Focus on CBDs and commercial areas) |

| Dinner | 5:30 PM – 8:30 PM (Focus on high-density residential areas and popular restaurant strips) |

| Weekends | All day, especially Friday and Saturday evenings |

2. Understand Surge Pricing

Uber Eats uses Surge Pricing (often called “Boosts” or “Quests”) to incentivize drivers to work in specific areas during high-demand times. Look for areas highlighted on the map to maximize your per-delivery rate.

3. Minimize Downtime

The key to a high hourly rate is minimizing the time between deliveries.

•Stay in Hotspots: Position yourself near clusters of popular restaurants.

•Be Selective: While declining too many orders can sometimes affect the offers you receive, learn to quickly identify and decline low-paying or long-distance orders that are not worth your time.

Earning Potential: The Australian Reality Check

While some drivers report high earnings, the reality is that your net income is highly variable.

Your actual take-home pay must account for your expenses, which include:

•Fuel/Electricity

•Vehicle Maintenance and Depreciation

•Insurance

•Tax (Income Tax)

After expenses, the hourly rate can fluctuate significantly. Uber Eats is best viewed as a flexible, supplementary income source, not a guaranteed minimum wage job.

I am Thejas Mohan – the TJS VLOGGER

My passion for vlogging has helped me to explore the opportunities available in the internet world.

I am successfully running my YouTube channel and I share videos about generating online income and how to do a side hustle that can support your life

I am passionate about vlogging and filmmaking